PA Educational Improvement Tax Credit Program (EITC)

& Opportunity Scholarship Tax Credit Program (OSTC)

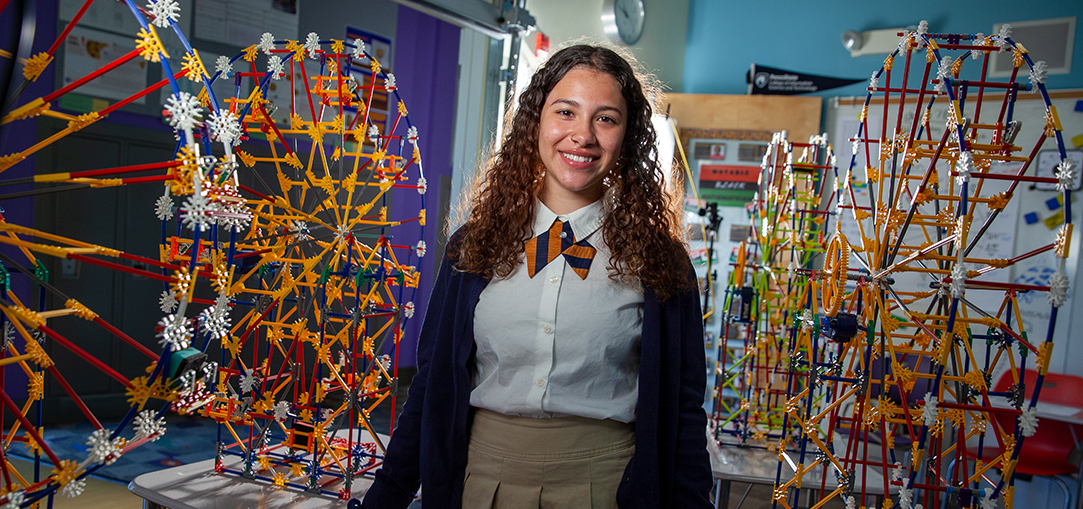

Convert your tax dollars into scholarships for the deserving and hard-working students of

The Neighborhood Academy

✓ Apply for a tax credit of up to 90% of your desired donation for a two-year commitment.

✓ Eligible businesses include C-corporations, S-corporations, partnerships, LLC's and most other pass-through companies including qualified Subchapter S Trusts. Consult with your tax advisor to confirm eligibility.

✓ Preferred minimum contribution for individuals, $3,500. Exceptions apply.

Consult your tax professional for specific tax advice.

For Individuals & Business Owners:

Organizations Like the Central PA Scholarship Fund can provide tax credits to individuals and businesses through a Special Purpose Entity. www.pennsylvaniaeitc.org

For Businesses:

If you pay taxes in Pennsylvania you can take advantage of the Educational Improvement Tax Credit or Opportunity Scholarship Tax Credit programs offered by the State to impact education. Any qualifying business can participate, so please share this information with any colleagues who may want to receive tax credits while supporting The Neighborhood Academy. Applying is easy, but there is a cap on funding, and applications are accepted on a first-come, first-served basis. Applications for businesses in the middle of a two-year commitment and returning donors will be accepted starting May 15th. New applications will be accepted beginning in July. Depending on your business structure, you may also participate through the Central PA Scholarship Fund. Please consult your tax professional on how these programs may impact your business.

EITC application and guidelines

OSTC application and guidelines

To see the impact of your contribution through the EITC program, please use the calculator below:

(for estimation purposes only; please consult your tax professional)